CA FL-825 2012-2024 free printable template

Show details

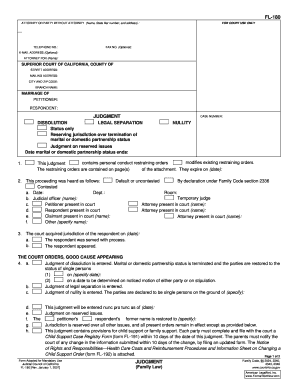

NOTICE OF ENTRY OF JUDGMENT 2. You are notified that a judgment of dissolution of marriage a. b domestic partnership was entered on date Clerk by Deputy The date the judgment of dissolution is entered is NOT the date your divorce or termination of your domestic partnership is final. For the effective date of the dissolution of your marriage and/or domestic partnership see the date in item 1a. Page 1 of 2 Form Adopted for Mandatory Use Judicial Council of California FL-825 New January 1 2012...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your fl 825 2012-2024 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fl 825 2012-2024 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fl 825 online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit form fl 825. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

CA FL-825 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out fl 825 2012-2024 form

How to fill out fl 825?

01

Gather all required information: Before filling out fl 825, make sure you have all the necessary information at hand. This includes personal details, such as your name, address, and contact information, as well as any relevant employment or financial information.

02

Understand the purpose: Familiarize yourself with the purpose of fl 825 to ensure you provide accurate and complete information. Whether it is a form related to taxes, insurance, or any other specific purpose, understanding its function is crucial for filling it out correctly.

03

Read the instructions: Carefully read the instructions provided with fl 825. Instructions will guide you through the process and provide clarity on how to complete each section of the form. Make sure to understand any specific requirements or steps mentioned.

04

Fill in the personal information: Start by filling in your personal information, including your name, address, phone number, and social security number. Double-check for accuracy and legibility to avoid any potential errors or delays.

05

Provide relevant details: Proceed to fill in any additional information required in the form. This can vary depending on the purpose of fl 825, but it may include employment details, income information, and other relevant data. Be thorough and ensure all requested information is provided.

06

Review and proofread: Once you have completed filling out fl 825, take a moment to review your answers. Double-check for any missing or incorrect information. Pay attention to details such as spelling, dates, and numbers. Proofreading helps minimize errors and ensures the form is filled out accurately.

Who needs fl 825?

01

Individuals filing taxes: Fl 825 may be needed by individuals who are required to file their taxes. It could be a specific form related to income reporting, deductions, or any other tax-related information.

02

Insurance beneficiaries: In certain insurance situations, fl 825 may be necessary for beneficiaries to claim their benefits. This could involve providing details such as proof of death, policy information, and other relevant documentation.

03

Financial institutions or lenders: Financial institutions or lenders may request fl 825 from individuals applying for loans, mortgages, or lines of credit. The form may be used to gather financial information to assess creditworthiness and determine loan terms.

Overall, fl 825 may be required by various entities for different purposes related to taxation, insurance, or financial transactions. It is essential to understand the specific needs and requirements of the organization or agency requesting the form.

Video instructions and help with filling out and completing fl 825

Instructions and Help about fl 825 pdf form

Fill 825 form pdf : Try Risk Free

People Also Ask about fl 825

How much is the summary dissolution fee in Orange County?

What is the difference between a summary dissolution and a dissolution?

Is a summary dissolution the same as a divorce?

What is a FL 825 form?

What is a summary dissolution in Orange County court?

What is the FL 830 form?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of fl 825?

Form FL-825 is a document used by California courts to provide notice to a party or parties in a family law case. It is used to inform the recipient of any updates or changes in the case, such as a filed petition or motion, a hearing date or time, or a change of address.

What information must be reported on fl 825?

On Form FL-825, the employer must report the employee's name, address, Social Security number, wages, tips, and other compensation. The employer must also report the hours worked, the rate of pay, the amount of Social Security and Medicare taxes withheld, the amount of federal income tax withheld, and any deductions taken out of the employee's wages.

How to fill out fl 825?

1. Start by filling out the form’s identifying information, including the name and address of the filing party, the case number, and the court in which the form is being filed.

2. In the “Type of Motion or Response” section, check the box that applies to the motion or response you are filing.

3. In the “Relief Requested” section, describe the relief you are requesting from the court.

4. In the “Grounds” section, provide a detailed explanation of the legal basis on which you are requesting the relief you have requested.

5. In the “Supporting Documents” section, list any documents you are attaching to the motion or response.

6. In the “Prayer for Relief” section, provide a specific request for the court to grant the relief you have requested.

7. Sign and date the form, and submit it with the required filing fee.

What is fl 825?

There is no specific meaning or definition for "fl 825" as it could be referring to different things depending on the context. Could you please provide more information or context to assist in giving a more accurate response?

Who is required to file fl 825?

FL 825 is a form used by employers in the state of California to report wages and contributions for employees participating in the Work Sharing Program. Employers who are participating in the Work Sharing Program and have employees working reduced hours due to a temporary slowdown in business may be required to file FL 825. The form is used to report the wages and hours worked by the employees so that they can receive partial unemployment benefits to make up for the reduced hours.

What is the penalty for the late filing of fl 825?

There isn't enough information provided to determine the specific penalty for late filing of FL-825. FL-825 typically refers to the California Family Law form used to request a court hearing regarding child custody and visitation issues. The penalties for late filing can vary depending on the specific circumstances, court rules, and jurisdiction. It is advisable to consult with an attorney or review the local court rules to determine the applicable penalties for late filing of FL-825 in a particular case.

How do I modify my fl 825 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your form fl 825 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit 825 form online in Chrome?

fl825 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an electronic signature for the fl 825 form in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your fl 825 form california in seconds.

Fill out your fl 825 2012-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

825 Form Online is not the form you're looking for?Search for another form here.

Keywords relevant to form 825

Related to judgement for dissolution

If you believe that this page should be taken down, please follow our DMCA take down process

here

.